Company Tax Rate 2019 Malaysia Calculator

Oto my is the best way to buy and sell new used and reconditioned cars in malaysia.

Company tax rate 2019 malaysia calculator. Introduced optional rm2000 special tax relief switch to comform to lhdn s standard. Resetting number of children to 0 upon changing from married to single status. Malaysia personal income tax calculator for ya 2020 malaysia adopts a progressive income tax rate system. What is income tax return.

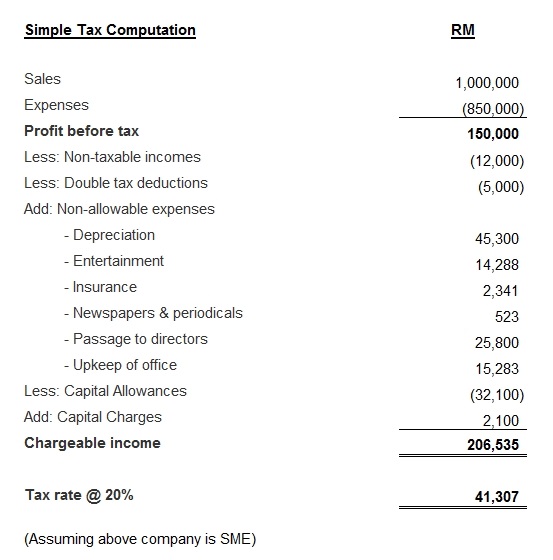

In the section we publish all 2019 tax rates and thresholds used within the 2019 malaysia salary calculator. Malaysia corporate income tax calculator for ya 2020 and after. Your average tax rate is 15 12 and your marginal tax rate is 22 50 this marginal tax rate means that your immediate additional income will be taxed at this rate. With our malaysia corporate income tax calculator you will be able to get quick tax calculation adjustments that help you to estimate and accurately forecast your tax payable amounts.

Use oto my to reach over 2 000 000 car buyers on malaysia s 1 automotive network. Or find your next car amongst the quality listings at oto my. On the first 5 000 next 15 000. Chargeable income myr cit rate for year of assessment 2019 2020.

Malaysia income tax e filing guide. With paid up capital of 2 5 million malaysian ringgit myr or less and gross income from business of not more than myr 50 million. Resident company other than company described below 24. On the first 5 000.

What is tax rebate. How to pay income. This means that low income earners are imposed with a lower tax rate compared to those with a higher income. This means that if you are aware of a 2019 tax exemption or 2019 tax allowance in malaysia that you are entitled too but it isn t listed here that we don t allow for it in this version of the malaysia salary calculator.

There are also differences between tax exemptions tax reliefs tax rebates and tax deductibles so make sure you. How does monthly tax deduction mtd pcb work in malaysia. If you make rm 70 000 a year living in malaysia you will be taxed rm 10 582 that means that your net pay will be rm 59 418 per year or rm 4 952 per month. Calculations rm rate tax rm 0 5 000.

Tax relief for year of assessment 2019 tax filed in 2020 chapter 5. Epf rate variation introduced. The system is thus based on the taxpayer s ability to pay. Tax rates for year of assessment 2019 tax filed in 2020 chapter 6.