Inland Revenue Board Of Malaysia Withholding Tax

Withholding tax is an amount withheld by the party making payment payer on income earned by a non resident payee and paid to the inland revenue board of malaysia.

Inland revenue board of malaysia withholding tax. Tax administration diagnostic assessment tool tadat association of tax authorities in islamic countries ataic perundangan. 10 2019 inland revenue board of malaysia date of publication. Withholding tax on special classes of income the malaysian inland revenue board in december 2019 issued guidance public ruling no. 11 2018on 5 december 2018 which supersedes the previous guidance on nonresident withholding tax on special classes of income pr no.

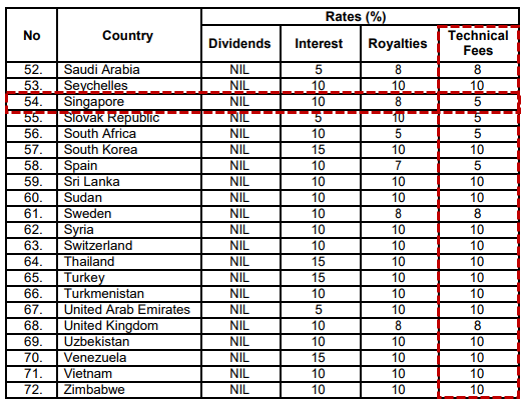

Tax whiz 5 april 2020 1. Responding to the tax compliance and administration impact from the implementation by the government of a movement control order mco which applies from 18 march 2020 to 31 march 2020 the inland revenue board irb has released a list of frequently asked questions faq the faq is available on the irb website. I interest1 except as exempted withholding tax under section 109 of the ita final tax at the rate as. 10 2019 withholding tax on special classes of income that replaces guidance from 2018 and incorporates certain changes that were made effective by reason of finance act 2018.

Payer refers to an individual body other than individual carrying on a business in malaysia. Certain receipts may be subject to withholding tax such as. Lembaga hasil dalam negeri malaysia bersama membangun negara aha 27 sept 2020 eng mal. Ruling reflects changes made by recent guidance and clarifies irb s current positions the inland revenue board irb of malaysia issued public ruling pr no.

Inland revenue board of malaysia date of publication. He is required to withhold tax on payments for services rendered technical advice rental or other payments made under any agreement for the use of any moveable property and paid to a resident payee. A a a size a. 10 december 2019 page 4 of 42 the fees of rm2 857 14 is subject to a withholding tax of 10 under section 109b of the ita.

Income is deemed derived from malaysia if. The effective date of each relevant paragraph in a public ruling follows the effective date of the related provisions in the income tax act 1967 income tax exemption income orders or income tax rules. Quoting directly from the inland revenue board of malaysia s official website withholding tax is an amount that is withheld by the party making payment payer on income earned by a non resident payee and paid to the inland revenue board of malaysia irbm. Chief executive officer director general inland revenue inland revenue board of malaysia.

1 2014 last amended on 27 june 2018.