Monthly Tax Deduction Malaysia 2018

Tax relief for year of assessment 2019 tax filed in 2020 chapter 5.

Monthly tax deduction malaysia 2018. About simple pcb calculator pcb calculator made easy. What is income tax return. 2018 1 march 2017 28 february 2018. Epf deduction is rm1 100.

The acronym is popularly known for monthly tax deduction among many malaysians. Monthly net income based on regular month non bonus month. This is mandatory in that neither the employer nor employee has any choice in the matter. Non resident employee mtd of an employee who is not resident or not known to be resident in malaysia shall be calculated at the rate of 28 of his remuneration.

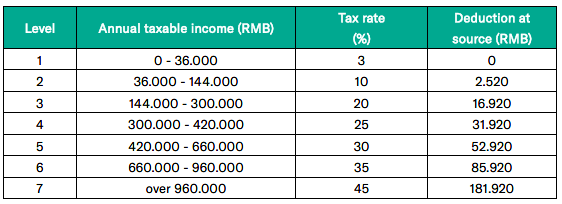

Here s the full list of income tax relief 2018 malaysia. Eis at 0 2 employer 0 2 employee contribution capped at eligible monthly salary contribution rm4 000 rm16 per month. Tax rates for year of assessment 2019 tax filed in 2020 chapter 6. Simple pcb calculator is a monthly tax deduction calculator to calculate income tax required by lhdn malaysia.

Simple pcb calculator is a monthly tax deduction calculator to calculate income tax required by lhdn malaysia. Monthly tax deduction mtd or pcb potongan cukai bulanan was introduced in january 1995 is a system of tax recovery where employers make deductions from their employees remuneration every month in accordance with the pcb deduction schedule. Pcb stands for potongan cukai berjadual in malaysia national language. Inland revenue board of malaysia.

For pcb on bonus month add both monthly tax deduction pcb and pcb on bonus. How does monthly tax deduction mtd pcb work in malaysia. An employee receives a monthly remuneration amounting to rm10 000. There are 2 types of residence status as follows.

Employer whose compute pcb using the schedule of mtd shall base on gross taxable remuneration less epf inclusive epf for non taxable remuneration allowance limited to rm500 per month if the actual deduction exceeds rm500. Monthly tax deduction tables annual tax deduction tables 2015 1 march 2014 28 february 2015 weekly tax deduction tables fortnightly tax deduction tables monthly tax deduction tables annual tax deduction tables 2014 1 march 2013 28 february 2014. Monthly tax deduction mtd for computerised calculation the mtd calculation depends on the residence status of the employee. What is tax rebate.

How does monthly tax deduction mtd pcb work in malaysia. Once you have submitted the form to lhdn and a copy to your employer your employer will have to remit the amount deducted to inland revenue board malaysia irbm also known as lhdn every month in accordance with income tax deduction and remuneration rules 1994. The acronym is popularly known for monthly tax deduction among many malaysians.