Section 33 Income Tax Act Singapore

13ca offshore fund tax exemption 13r onshore singapore resident company fund tax exemption scheme 13x enhanced tier fund tax exemption scheme.

Section 33 income tax act singapore. The recent income tax amendment act1 introduced a new anti avoidance provision in place of the old provision in section 33 of the income tax act 2 by this move singapore joined the ranks of nations with wider anti avoidance provisions. One of the main exclusion is immovable property in singapore. The current version of section 33 of the income tax act which sets out singapore s gaar was promulgated in 1988 to deal with increasingly complex and bespoke tax avoidance schemes. To date there are two income tax cases dealing with the application of this section.

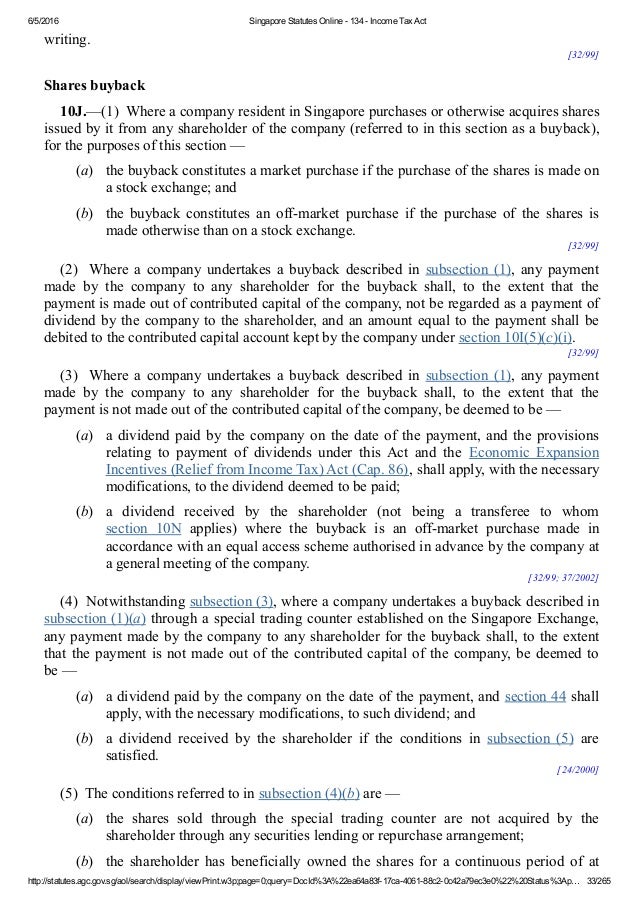

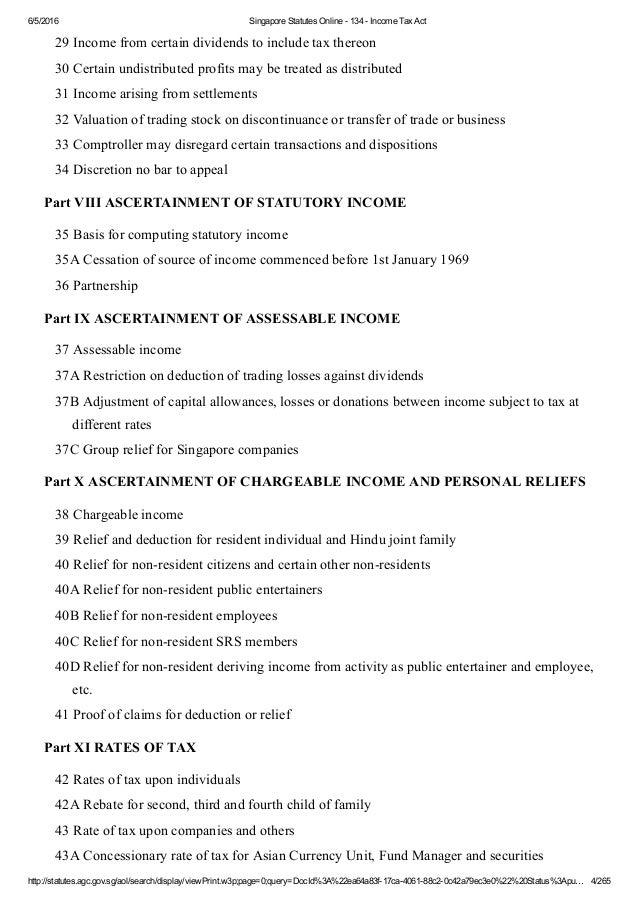

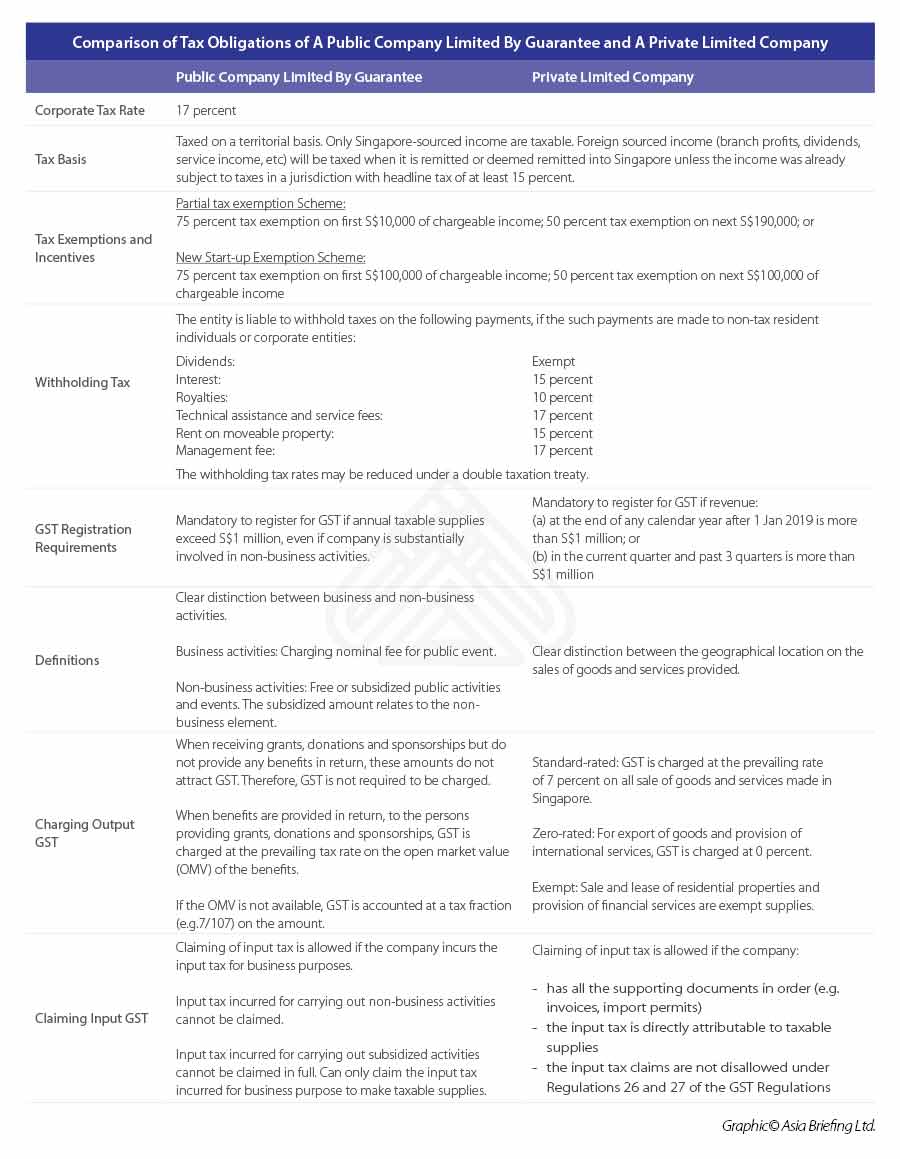

1 subject to this act the adjusted income of a person from a source for the basis period for a year of assessment shall be an amount ascertained by deducting from the gross income of that person from that source for that period all outgoings and expenses wholly and exclusively incurred during that period by that person in the production of gross income from that source including. Or 91 4 or section 44 19 in force immediately before 1st january 2014 shall be deemed to be interest on tax for the purposes of section 33 2 of the limitation act cap. Income tax act chapter 134 status. These tax incentives are outlined in section 13ca 13r and 13x under the singapore income tax act.

This provision gives the comptroller of income tax the discretion to disregard or vary any taxpayer arrangement to counteract any tax advantage obtained as a consequence of it. Income tax act act income tax act subsidiary legislation legislation is reproduced on this website with the permission of the government of singapore. Comptroller means the comptroller of income tax appointed under section 3 1 and includes for all purposes of this act except the exercise of the powers conferred upon the comptroller by sections 34f 9 37ie 7 37j 5 67 1 a 95 96 96a and 101 a deputy comptroller or an assistant comptroller so appointed. Singapore s gaar are found in section 33 of the income tax act and have been in place in their present form since 1988.

Section 13 mainly defines income sources that are specifically exempted from singapore income tax. 86 recovery of tax from persons leaving singapore. Such sources include interest earned on qualifying debt securities shipping profits income earned by approved a licensed fund manager and gain from disposal of shares. Acts of parliament are available without charge and updated monthly at the singapore statutes online website.

Similar provisions exist in the goods and services tax act and the stamp duties act.