Service Tax Act 2018 Pdf

The sales tax act 2018 and service tax act 2018 received royal assent on 24 august 2018 and were gazetted on 28 august 2018.

Service tax act 2018 pdf. B 508 2018 enacted by the parliament of malaysia as follows. Persons liable to pay the tax. Communication service tax act 2008 act 754. National youth employment support.

1 this act may be cited as the service tax act 2018. This form is used to determine the amount of the tax that you owe. Imposition of communication service tax. The following act of parliament received the assent of the president on the 29th august 2018 and is hereby published for general information the central goods and services tax amendment act 2018 no.

Part i preliminary short title and commencement 1. The central goods and services tax amendment act 2018 no. 23 federal unemployment tax act of subtitle c employment taxes of the internal revenue code imposes a tax on employers with respect to employees. Section 6011 requires you to provide the requested information if you are liable for futa tax under section 3301.

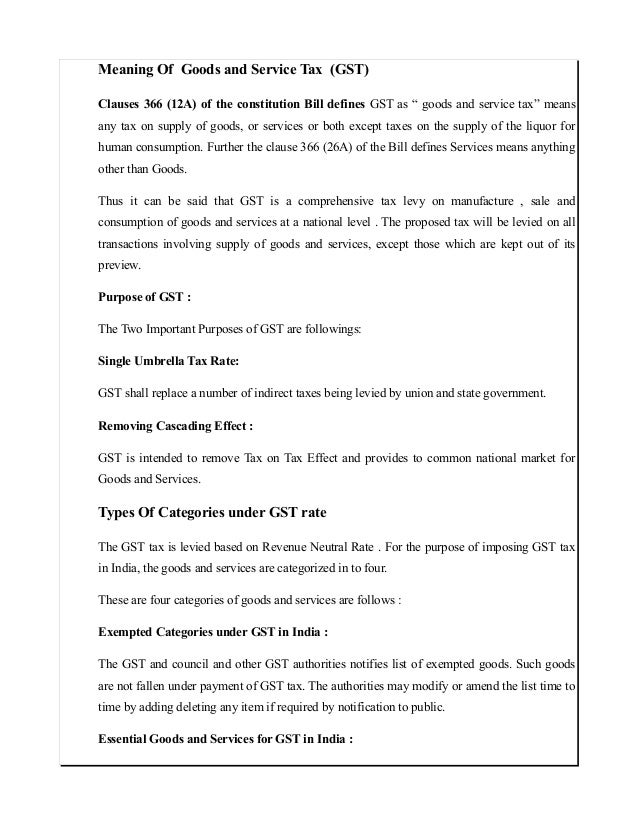

Rate of tax. The service tax act 2018 sta 2018 applies throughout malaysia excluding designated areas free zones licensed warehouses licensed manufacturing warehouses and joint development area jda. Arrangement of sections. Ii provided in malaysia.

New delhi the 30th august 2018. Enacted by the parliament of malaysia as follows. Act 807 service tax act 2018 an act to provide for the charging levying and collecting of service tax and for matters connected therewith. 1 september 2018 p u.

31 of 2018 29th august 2018 an act further to amend the central goods and services tax act 2017. Service tax is charged on. Submission of tax return and time for payment of the tax. This bill seeks to repeal the goods and services tax act 2014 act 762.

Collection of the tax and payment into consolidated fund. 31 of 2018 29th august 2018 an act further to amend the central goods and services tax act 2017. 2 this act comes into operation on a date to be appointed by. This is due to the implementation of the new tax system namely sales tax and service tax as proposed under the sales tax bill 2018 and service tax bill 2018 which will replace the goods and services tax imposed under act 762.

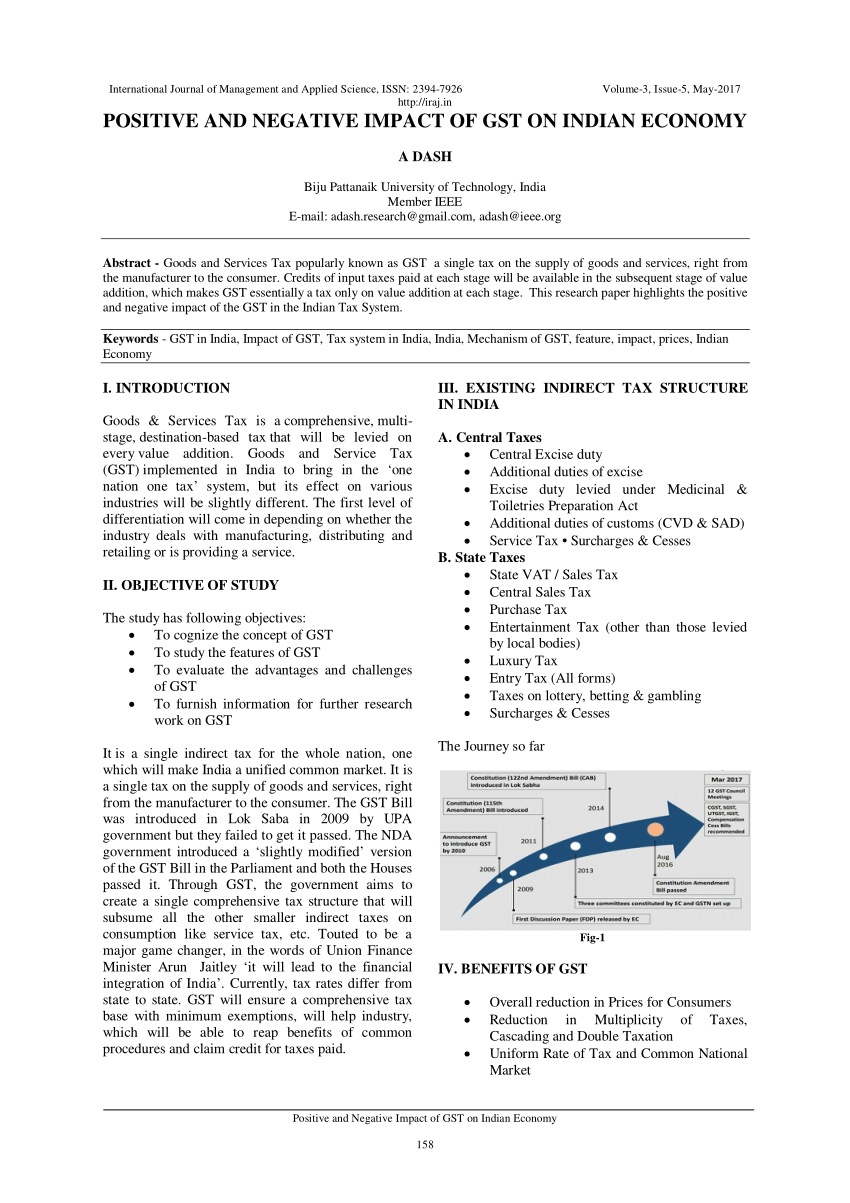

P art i preliminary short title and commencement 1. Charge to tax 6. The sales tax and service tax acts provide for the implementation of a new tax system namely the sales and service tax sst that will replace the goods and services tax gst. 1 this act may be cited as the service tax act 2018.

I any provision of taxable services.